Let’s share with you what we’ve found useful and why we think you will like it too. If a video is more your speed, take a quick tour with Megan:

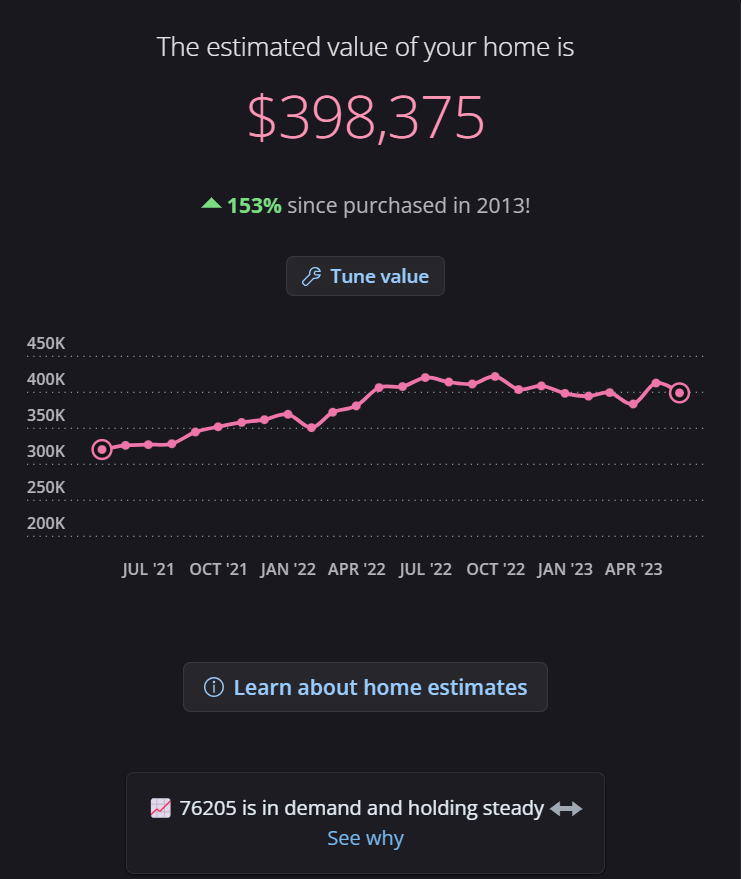

The first thing that you’ll see on a Homebot email is the estimated value of your home. As seen in this example, you’ll get a simple graph to easily see changes over time. There’s an option to fine tune this number by providing a tad more detail if you desire.

This data provides you with a quick snapshot that allows you to track the value of your investment. This kind of visibility helps provide certainty. We know sometimes people get curious about numbers and don’t want to ‘bother’ their Realtor. (Psst, it’s never a bother).

This service requires no added work and eliminates any concern of bothering us. It’s just a simple email. If we’re being honest, we’ve opened every single email received from them to first take a look at this chart.

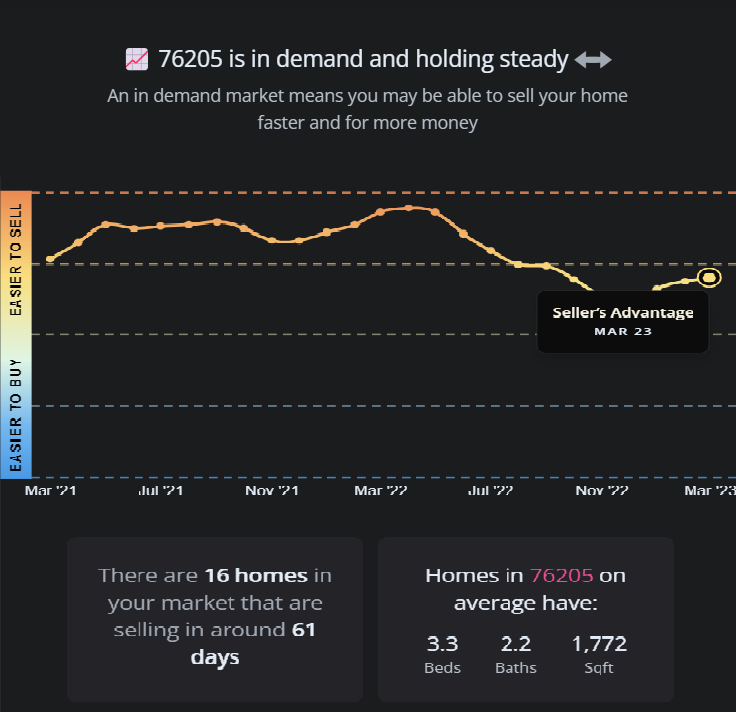

The next area on a typical email shows the basic sentiment, or trend for your own zip code.

With this chart, you’ll be able to gauge the battle between Buyers and Sellers in your area. Is it easier to sell? Or buy? Who has the current advantage?

Why do we think this info is useful? Timing!

Perhaps you’re not in your forever home. Or maybe you have selling on your radar. If that moment to make a change comes, you’ll next wonder (before calling us): Is it a good time to do so?

If you do sell (for whatever reason), we want you to be in the best position possible! The ability to time and track this sentiment can help you capitalize on that advantage, or avoid giving up any gains that you’ve worked so hard to get.

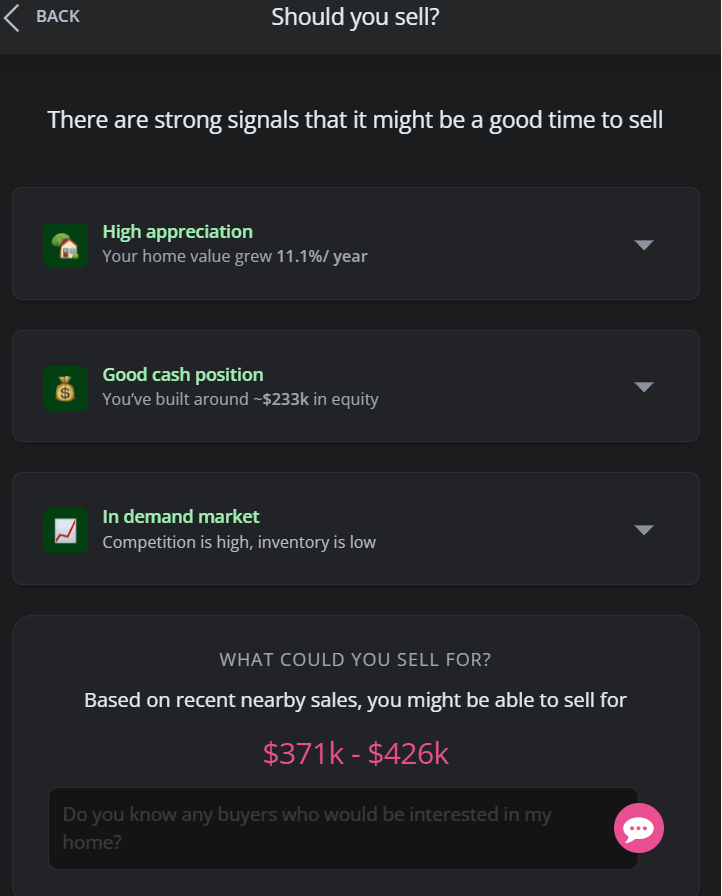

There is a portion within Homebot where you can add your loan information. We discovered it helps to track your approx. net worth, equity and appreciation.

What do we like about this?

Well, what if the unknown occurred and you had to sell your house tomorrow? It happens. Are you in a good position to do so?

Monitoring this section can help ensure you’ve got positive equity and are able to maximize gains, should the need to sell arise.

If we can be real for a moment, a house is not just a home. For many, it’s the largest investment of their life. While we want you to love where you live, we also want you to build and leverage wealth.

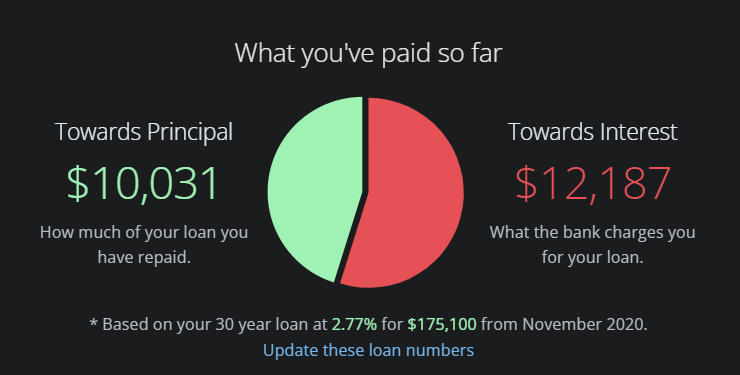

We found some other benefits with adding your loan information. One item is that it tracks your Principal vs Interest breakdown with an easy-to-read pie chart. How’s your progress? Are you on track?

You can also drill further down for more detail to look at potential areas of opportunity.

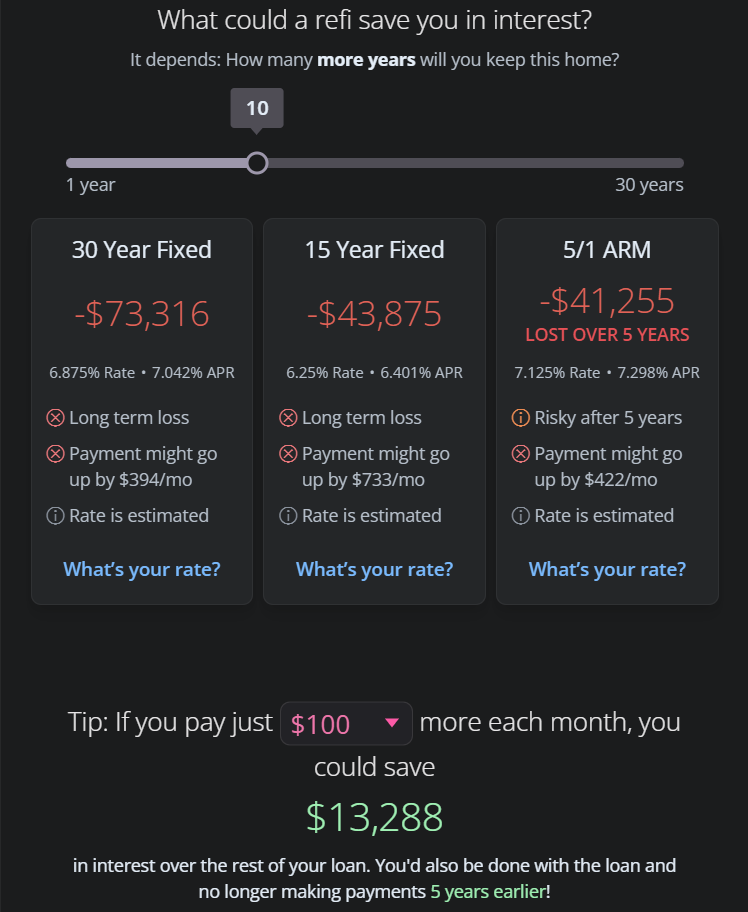

Digging deeper into this section, you can gauge how your mortgage rate is stacking up to others currently available. Would refinancing allow for any areas of benefit, or gain?

In this example comparing current rates, you see it’s not beneficial to refinance at this time. In 3-5 years, the situation might be different. Here you can track this question, with no extra work required on your part.

Why do we think this is valuable for you?

Because we want you to find the most effective use of your hard-earned money.

Would refinancing free up extra cash for other investments? Or help pay off your house faster? Maybe you discover you’re a little behind and need an alternate payment strategy. What impact would paying an extra $100 each month have on your loan?

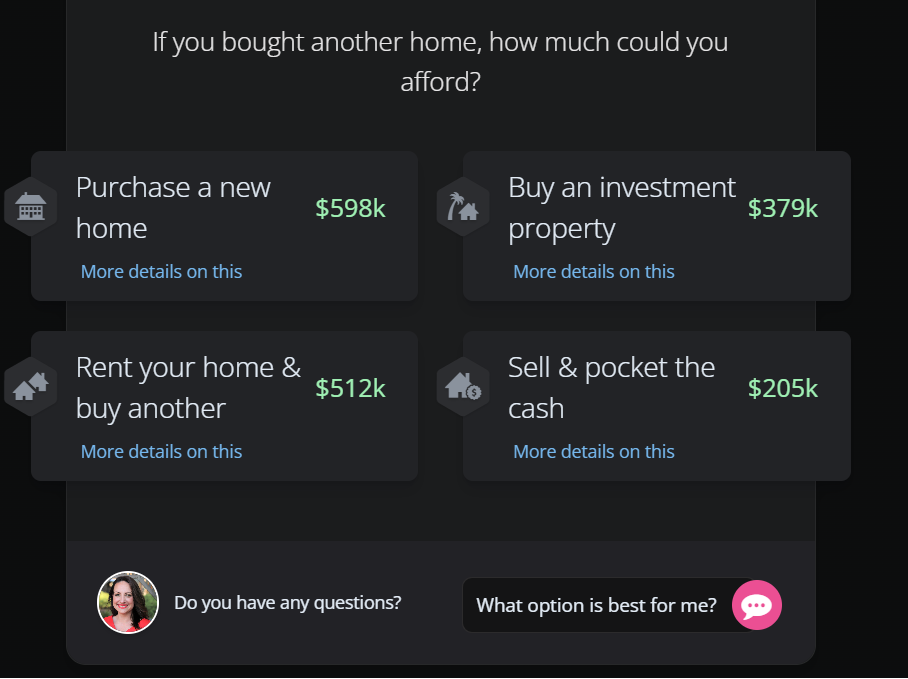

You’ve seen how Homebot tracks market value in relation to your equity. One last feature to highlight is your potential options.

Is your household growing and you need more space? Or are you looking to downsize? Let’s figure out how your buying power can help.

Do you need to tap into your equity due to an emergency, or a home improvement project?

Perhaps you want to explore other possibilities such as renting out your home? Or using your equity to buy an investment property?

Whatever your needs, we want you to be able to leverage your equity to work for you.

That’s a basic overview of how Homebot works. We’ve found it very useful, which is why we’re providing this to all our past clients for free. For transparency, we are not receiving any sort of kick-back or rebate by doing this. We simply want to continue to provide value to those who put their trust in us.

- Megan & Michael Bradshaw – Hometown Real Estate